Using the world’s newest and most innovative financial instruments to trade in ancient tokens of currency like emeralds and rubies may sound like a contradiction in terms.

It’s tough to imagine why a scrawny teen hacker riddled with body enhancements would trade Bitcoins for the kind of brooch you might have seen on the late Queen Mother’s lapel. To Desmond Marshall, chairman of Fang Fang Monte Carlo – purveyors of “fine gemstones for the modern lady” – bridging these vastly contrasting financial realms is just smart business. Not only does it repackage a distinguished trading platform for a fresh market cashed-up in cryptocurrencies, the move also forms part of an elegant strategy designed to mark the company as being worthy of investment in itself on Hong Kong’s troubled retail landscape.

“As a retailer or as a consumer brand, it’s quite imperative to make new leaps in innovation,” says Marshall, who will be speaking at this month’s Retail’s Cutting Edge event on January 31, part of the StartmeupHK festival. “We’re not just catering to normal consumers, individual customers who buy stuff. We are responsible to them as well, but we also have to be responsible to the investors at the back end. It’s a balance between chicken and egg; if you don’t have the consumers, then the investors will not be coming.”

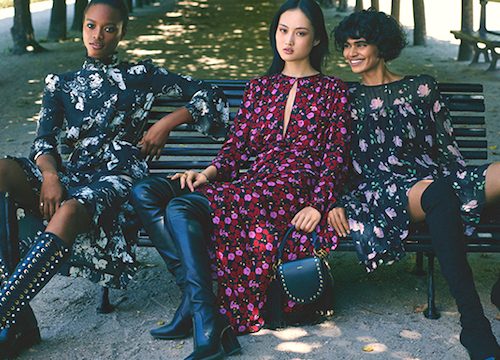

According to Marshall, most retailers have yet to grasp the degree to which post-millennials both understand and actively trade on blockchain networks. “We’re trying to tap into a younger generation,” he says, “those who are just graduating from school, who have been working for a few years. They may be going up the corporate ladder, and they’re saying ‘okay, I can’t wear cheap jewellery anymore, I’m management level, I need to see bigger clients, so I need to be a little more elegant.’ So that’s why we’re trying to move into that area.”

The flip side is that not only are these emerging markets highly investment-savvy, but traditional older-generation investors are now favouring businesses whose broader strategies embrace cryptocurrencies and tokenisation over consumer retailers reliant on slow sales cycles. It’s for this reason that Marshall is now focused on tokenising Fang Fang itself, infusing blockchain technology into the entire company. With this technology at the forefront, the way is paved to hold an ICO (initial coin offering) or ITO (initial token offering) later on for the purposes of funding or financing.

“We see things in a different light”

“Because we’re investors, we see things in a different light,” explains Marshall. “So in a way, when we’re investing into consumer retail brands around here, we’ll look at things in a more general, holistic way. Not just focusing on the consumer, but also focusing on the health and well-being of the company itself, on a longer-term basis. So moving into cryptocurrency, tokenising it, that actually helps future investors who are coming in and saying, ‘hey, I’m more interested in tokens or ICOs or bitcoins or cryptocurrency.’ If you’re just consumer retail, I can pretty much tell you that no one in Hong Kong will be interested.”

The modern investor, according to Marshall, is increasingly focussed on rapid turnaround in an environment where the stock market can yield faster and better returns than businesses trading in Hong Kong’s small consumer market. To be funded, projects need a higher probability of success than ever before – and increasingly, an established market in China.

“If you ask these conglomerates which is the better market,” says Marshall, “I can pretty much guarantee 200 per cent that they will be saying China. Hong Kong is like an advertisement. It’s good for a poster-boy kind of branding, helping us to tap into the China market, helping us to get more investors, and so on. So that’s the mentality.”

Fang Fang’s Gem IPO program is a further example of its multifaceted approach. The firm’s intimate connections with gem-mining operations provides them with early opportunities to reserve the highest-quality raw stones on behalf of clients – who can then elect to augment and enhance the gems’ value by incorporating them into intricately-designed jewellery destined for top-dollar sale at distinguished auction houses. Fang Fang stands to profit from the trading as well as from its atelier design services.

“Gemology is an ancient business,” says Marshall. “It’s nothing new. In terms of consumer retail, it’s been around since daybreak. So I see the gap, in terms of these younger-generation females – the Millennials are even getting old – but there is a younger generation coming along here; they are more into cryptocurrency, they’re more into new social media. Even Instagram is old for them. They’re looking for new ways of talking to their peers, and they are not buying the old brands. Even brands that are three or five years old, they think they’re old already. They’re looking for something new and much more exciting.

“Because of our connections, we’re looking at emeralds, sapphires, and rubies, which people normally think of as old stuff. Queen Elizabeth. But everyone’s look for something fresh, so why can’t we put a fresh spin on this? That’s the reason why we’re trying to capture a younger audience, and telling them that it’s not old, it’s something that you can wear with pride and joy, with confidence. And adding the cryptocurrency, the tokenisation, the Gem IPO, where younger and younger people are making investments, it’s just normal. You go to university, they have all these stock gaming challenges, buying stock and becoming the next broker.

Everyone is looking at how to grow and make money on their investment. So I’m just offering that as an option and saying, ‘if you do think of this as an investment, it’s a good one. You can just wear it, but if you want something serious, then you can put into the Gem IPO or buy something much bigger. You spend more now, a big rock, it will get a higher valuation in a shorter period of time.

“I think another part is that we’re turning out new product lines by the month,” he adds. “Not by the season. So in terms of that innovation, in terms of contemporariness, we are moving things much quicker. It’s pretty much what Zara is doing, but it’s not seasonal, because that’s the old way of thinking. Right now, people are not bound by your rules. They are bound by their own rules. ‘If I want it now, I want it now. I’m not going to wait for three months before you guys are doing it. I don’t care how good the designs are, I just want it now, I want it fresh, now.’

“Instant gratification is the new younger generation. If you don’t give instant gratification, you’re not in their field. So we give it to them.”